QuickBooks Desktop Job Costing: The Beginner’s Cheat Sheet

If you want a version of QuickBooks for service professionals, it shouldn’t be difficult to obtain one because QuickBooks Pro, QuickBooks Premier, QuickBooks Accountant Edition, and QuickBooks Enterprise (all subscription levels) include this feature. Start your digging and delve into the why, the how and the when of QuickBooks Job Costing.

Does Job Costing Apply to My Business When I’m not a Contractor?

The importance of tracking job costs is segmentation of jobs, tasks, or projects underneath a parent entity. For construction companies, it typically means having a person (at the top level within your customer list) or a company’s project as the parent. Underneath, you will have a variety of items you can label any way you want.

If you are a retail business, you can still use job costing in QuickBooks Desktop to track your many locations; track their individual profitability, productivity in order fulfillment, and so on. If you read on further, you will see how QuickBooks’ flexibility benefits retailers – brick and mortar or eCommerce types.

How Does Job Costing Work in QuickBooks?

The outlined section in this QuickBooks sample company file indicates Regina French Homes is the company or client the sample company conducts a majority of its correspondence with.

Regina French Homes has projects (from the looks of it) it wants the company to do – based on the street name where it provides products or services, or both.

In this immediate example, the company was just awarded the Spring Street job – per the Awarded flag next to Job Status.

We click onto the entity “Wrong Way Rd,” because there weren’t transactions for “Spring Street”. We do see transactions this time.

Zooming into the highlighted invoice, you see how the sample company relates to the sub entities more clearly. The flag of “Automatic Pool Systems” in the class dropdown indicates this transaction is for a a purchase of one of the company’s automatic pool systems.

It involves item purchases: two inventory part purchases – the Ultimate 3000 pool system, and a Forest Green Pool Cover; and a service item: Installation labor. The service item is conveyed in the invoice through its Site and Bin rows being unpopulated – as it doesn’t draw any quantity.

Secondly, the fractional quantity communicated in its Quantity row conveys two and a half hours of time were spent for the installation of the pool system and its accompanying pool cover.

What you may find helpful is how the two columns – Base Rate and Price Each – show a differentiation. To double check how this may play out in reporting data, you typically run an Estimates vs Actuals report.

You can get there by clicking on the hyperlink “Estimates vs Actuals”. Based on what’s on screen, so far, it does not appear the report will provide substantial information. Let’s see what the results are from running that report:

Paying attention to the columns throughout the report, it points to the likelihood of no estimated data been entered for this particular job or customer.

Why wasn’t there estimated data? Filtering the transactions to Estimates, and the date range to All, reveals this particular job wasn’t given a bid or quote from the outset of this particular process. What about that particular invoice we used as a example?

Going to the Formatting tab of the invoice and clicking on to Customize Data Layout, you get into the customization process for the invoice form template; this is applicable for any form having the formatting tab available.

Within, getting to the Columns section, you notice base rate being enabled for just screen, not print. This clearly illustrates this is for company eyes only, which is a good start for tracking what you normally assess for products and services you provide vs what you agreed to assess on behalf of your customers. What if you want to get more information from running reports?

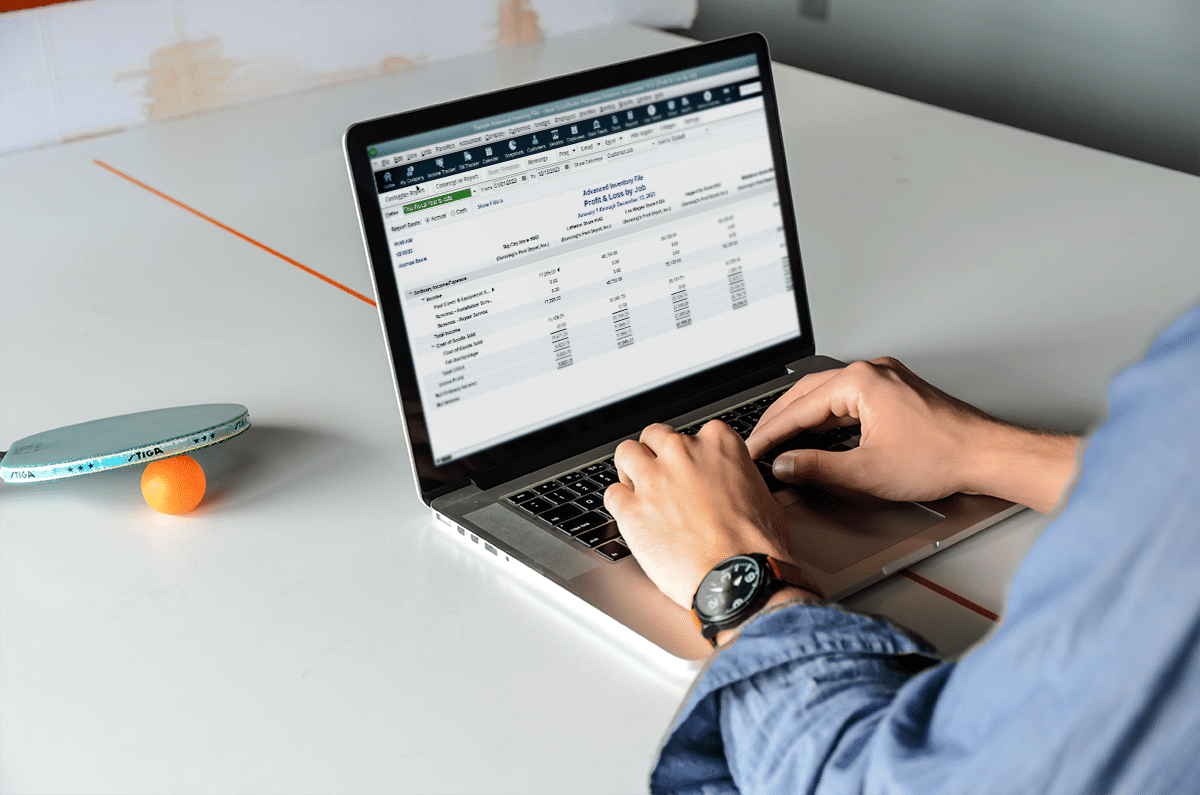

In this profitability detail report, the numbers delivered are based on the cost set forth for those items included in invoices for this particular job and pit against the rates used in the same invoices, not the rates specified during item creation in the Items List.

From this standpoint, you still are not able to get the detail you need for estimates vs actuals – which involves the utilization of the Estimates form in QuickBooks. Estimates have the ability to track changes therein, since their initial creation – whether you look at updating quantities, or pricing.

Looking for a view of what an estimates vs actuals report reveals, we opened up the contractor’s sample company file. We needed to make sure estimates were included before running the Estimates vs Actuals report.

Going into the Customer Center, and clicking onto the Transactions tab show there are the requisite Estimates transaction types. Because of this, you should see data within the Estimates vs Actuals report.

This is a summary report categorized by all jobs. From this, you get a birds-eye view of a what your costs were going to be vs. what they actually are; and the same is conveyed for revenue tracking. The last column – Diff indicates whether you stood to lose or gain from each job.

Here is an item by item breakdown of estimated cost vs actual cost; the estimated revenue vs actual revenue; and seeing if you stood to gain or lose from each item.

This will show a line item detail for a specific customer you have to select before running the Estimates vs Actuals Detail report.

This Item Profitability report shows an item-by-item breakdown of profitability, and the overall item profitability – when scrolling all the way to the bottom.

At the end of the day, these are only a few of the reports you can run to track how jobs, or projects play a role in your company’s financial fitness. Although we did use specific company files to illustrate principles and concepts discussed, you can use this type of tracking and reporting for other industries.

I recall encountering use cases involving subsidiary companies and locations underneath a parent company for retail use. You can track the profitability, productivity, and progress for each subsidiary – using the same processes lined out above.

You can provide personal estimates or quotes to each subsidiary, then invoice them at the prices ultimately agreed upon by each respective subsidiary. You can, then, stack each subsidiary; and see which one has been more profitable, or had more sales volume than the others, etc.

How Do I Track Job Costing Better in QuickBooks Desktop?

To maximize your job costing analytics, you may explore an area of customer data not often explored – whether during initial customer setup, or post customer creation – the Job Info tab of customer or job. Here, you provide attributes surrounding each job:

- Job Description: describing in more detail the nature of the job being done on behalf of a customer or a location.

- Job Type: what kind of job is being executed for this client or location. In this sample file it only has the option for custom design.You have the potential to be more detailed by adding more types to indicate what may have been more profitable, or where your team may have been more productive during specific periods of time.

- Job Status: you are set with six available statuses to flag each project or job. What you select will likely depend on how your company defines the meaning for each status. Below, however, are typical use cases for each option.

- Pending for negotiations phase

- Awarded for having been given the opportunity to work on the job

- Not Awarded for losing the bid to do work for that job or client

- In Progress indicates being awarded the job and is being worked on

- Closed indicates the job being completed

- None indicates it hasn’t begun the bidding process.

- Start Date: the day you start your work on the project.

- Projected End Date: when your organization believes it will have the project completed.

- End Date: when the project actually ended.

By populating these fields; and utilizing Estimates, you can get a better view of not just dollars and cents, but overall productivity – with respect to a given project pipeline.

When you utilize progress invoicing, you can track more precisely track the life of a given job, project or order (in the context of retail stores); and see the data revealed through the Progress Invoices vs. Estimates. For retail stores, you can set the progression based on quantities you are able to fulfill – then invoice on the customer’s behalf.

What is the Job Status Dropdown in QuickBooks Good For?

When you make fuller use of the Job Status drop down for your customer, especially when taking advantage of In Progress and Closed dropdown options, you can use the Jobs WIP Summary report in QuickBooks Desktop.

This is based on the comparison between what’s in the estimate, and what it has been invoiced against it. If you especially use the percentage-based progress invoicing, % Complete will draw its figures from how much of the estimate has been invoiced.

How Do I Best Use the QuickBooks Jobs WIP Summary Report?

Looking at report filters, you can make use of all Job Status Types. The concerns here may be the setting to only one of the status flags. Some businesses may want to be able to see more than one status simultaneously – instead of having to run a report for each job status.

Something like this definitely sounds like a handy product enhancement suggestion you can send from the Help section of QuickBooks, then going to Send Feedback Online, and selecting Product Suggestion; that’s unless it’s something already submitted. If that’s the case, I’m sure developers are looking at implementing and testing its integration into the overall software – as we speak.

Maybe, for example, we request to the ability to include Job status as a checkbox in the Display tab when customizing this report.

Can I Generate a Report Where Job Statuses are Listed Simultaneously?

After some digging, we discovered the ability to use the Customer Contact List Report. There are things you want to keep in mind, when using it; these being:

- It requires customization and filtering of data attributes

- It is a list-based report, meaning no analytical data is presented therein.

Despite those pointers, you can pull numbers by adding columns – Balance, Days Overdue. You can add more informational detail by adding columns for Job Status, Job Type, Customer Type, End Date, Projected End Date, Rep, etc.

Depending on how focused you want such a report to be, you may find yourself removing a host of columns inessential to your reporting objectives; you will then be adding essential ones simultaneously to get where you need to be.

Here is an example report, after removing irrelevant columns and adding relevant columns to the report. I’m sure there are some other columns coming to mind you may want to add to this, as well.

Given the amount of time such customization may take, you can can rest easy in the ability to memorize the report; this report can then be exported – so you can restore it in the event you run into data integrity issues.

Can a Retailer Make Use of the WIP Summary Report in QuickBooks?

What we discovered in the progress invoicing process is progressing based on quantities will not carry into the WIP Summary report completely. Instead, you will want to use the Sales Order to Invoice process, which will help better track quantities on back order for retail businesses.

As you can see, % Complete is seemingly based on the percentage-based progression. It appears to tie count-based quantities only in the ($) Diff. column and Act Revenue column. This may throw off proper interpretation of the reporting data in front of you.

What Do I Need to Know About Item Profitability and Job Costing in QuickBooks Desktop?

Proper item creation is essential to proper tracking of job costs in QuickBooks. Depicted above is the process of creating a service item based on the context of work done on behalf of your company via subcontractors.

The same can be done for non-inventory part and inventory assembly item types. This ensures accurate tracking of particular items you need to keep tabs on.

The more detail you provide here, the greater amounts of data you give QuickBooks reporting to reveal insights about how your business is doing.

What Can Throw Off My Calculations for Profitability in QuickBooks?

An occasional occurrence may be the misplacement of a credit to a job/project, while intending to credit another. Thankfully, QuickBooks Desktop 2019 – QuickBooks Pro, QuickBooks Premier, QuickBooks Accountant Edition or Enterprise – has the capability to transfer credits among jobs more smoothly than past versions, where it only takes a couple of button clicks.

We do have a recording of this feature in action from our webinar where we highlighted the many new features found in QuickBooks Desktop 2019.

Until Next Time

Thank you for peeking at this cheat sheet into the world of tracking your job costs, using QuickBooks Desktop. If you have been utilizing this feature for some time, great! If you possibly find some anomalies you didn’t expect in reporting, item valuation, job and project tracking, etc. don’t hesitate to reach out to your ebs QuickBooks consultant.

Empowered through such a partnership, you will be assured of a thorough review of your QuickBooks company file with a team of ebs bookkeeping experts and financial controllers at your disposal.

If this is going to be your first time venturing into job costing with QuickBooks, the same will take care of you as well. Don’t hesitate to start the conversation – whether it’s for a financial tie out or a possible QuickBooks data migration. We are just a phone call away at (503) 885-0776 | Toll Free: (888) 232-4758; you can email us, or schedule your complimentary review, here.